What is Decentralized Finance (DeFi) Insurance?

To understand DeFi Insurance, we first need to consider its two main categories.

DeFi Risk Insurance: This insurance protects against risks unique to DeFi activities like investing in protocols. It safeguards against hacks and other threats inherent to decentralized finance.

DeFi General Insurance: This form of insurance uses blockchain technology to replace traditional insurance policies like life, auto, and home insurance. It leverages the transparency, efficiency, and benefits of decentralized networks. In this article, we will cover and explain both scenarios.

Category One – DeFi Risk Insurance

The DeFi landscape continues to grow, with new enterprises, protocols, and applications emerging daily.

According to a recent report by Web3 development firm Alchemy, the number of active DeFi apps and decentralized exchanges rose 19% quarter-over-quarter in Q1 2023. This data underscores the accelerating adoption of DeFi as users seek to take control of their own assets and finances.

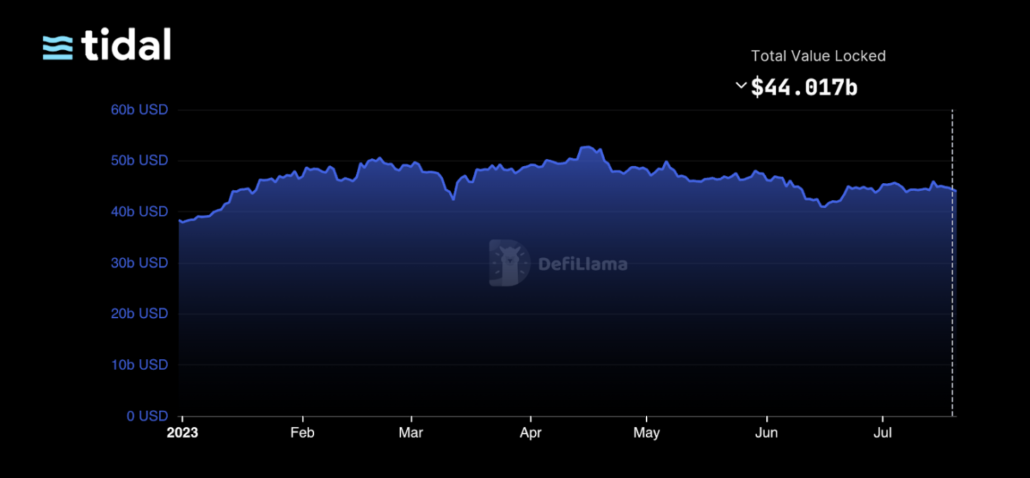

As of July 2023, the total value locked (TVL) in DeFi protocols is over $44 billion, a substantial sum that brings with it considerable risks associated with emerging technologies and unregulated markets. For example, according to DeFiLlama, since inception, DeFi users have suffered losses of over $6 billion due to technical and governance exploits.

DefiLlama reports the total amount of assets currently held (TVL) in DeFi protocols is 44.4 billion as of July 2023.

In response to the inherent risks in the DeFi sector, companies like Tidal Finance offer robust insurance solutions. These policies protect users against financial losses stemming from vulnerabilities in smart contracts, hacks, platform failures, and other risks specific to decentralized finance. As the DeFi sector matures, insurance is progressively being recognized as an indispensable tool for effective risk management.

Category Two – DeFi General Insurance

While DeFi insurance is great for risk management in the DeFi space, it can also replace traditional general insurance policies, leveraging the transparency, accessibility, and efficiency of decentralized networks.

For example, Tidal Finance’s v2 platform goes beyond crypto-related cases to onboard a diverse array of coverage policies, driving the broader adoption of decentralized insurance solutions. Tidal’s ambition extends to real-world insurance cases, with the belief that the advantages of blockchain technology can transform traditional sectors as well.

How Does Defi Insurance Work?

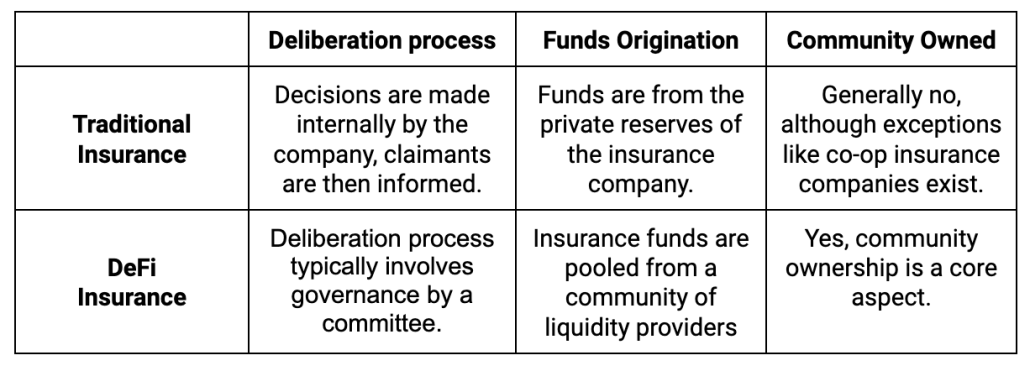

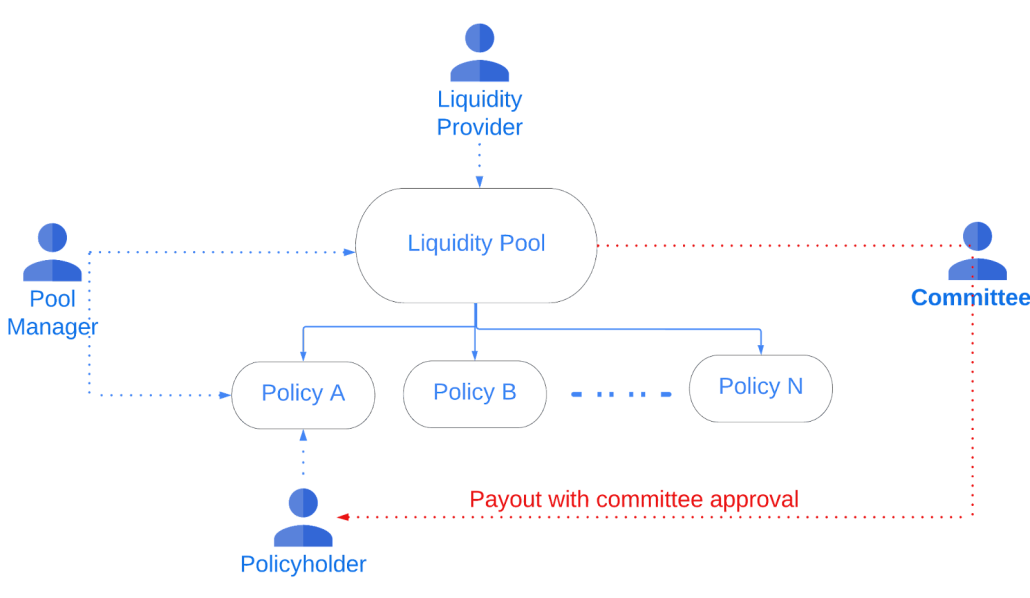

DeFi Insurance operates on a mutual model, where individual parties come together to collectively share risk, rather than depending on a single centralized insurance company.

Key features include:

Pool Managers work as underwriters in the insurance ecosystem, forming contracts between insurer and policyholder. If a policy falls into default, the pool manager will also assist with the claim and payout processes.

Liquidity providers act as syndates, supplying insurance collateral in exchange for policyholder premiums. Depending on the policy design, the collateral amount is typically much less than the coverage capacity that it supports, resulting in a high earning ratio.To ensure that sold policies have backup capital in the event of a default, withdrawing liquidity has a lockup term that is longer than the policy’s maximum length.

The exact withdrawal waiting term will be mentioned on the collateral contract in each pool. During the withdrawal period, liquidity providers might still earn premiums and face capital losses if a payout happens.

The capital loss is proportional to the entire asset value in the collateral pool. For example, if Bob’s deposit is 10% of the overall collateral pool and 100 USDC are used for payout, his loss is 100 x 10% = 10 USDC.

Policy Holders are the people who purchase the insurance policy. Each insurance has an effective period, and policyholders are eligible for compensation if the policy is activated during the effective period.If the required collateral amount falls below the outstanding insurance amount, policyholders are eligible for a return. A high payoff, for example, could set off such a scenario. The unprotected portion owing to a lack of collateral will be automatically reimbursed to policyholders’ wallets every week until there are sufficient collateral deposits to cover the outstanding policies.

Committees can provide governance of pay outs, ensuring a claim challenge mechanism is still in place and creating a fairer model vs traditional general insurance. Committees can also recommend changing the pool manager or adding or removing committee membersThis mutual model embodies the principles of transparency, inclusivity, and decentralization, perfectly aligning with the ethos of DeFi. The risk associated with underwriting is evenly spread out across multiple contributors rather than being concentrated within a single entity.

Can I Earn Rewards from DeFi Insurance?

In this system, liquidity providers supply the insurance fund with crypto assets. These assets are then used to pay out claims when an insured event occurs. In return for their contribution, liquidity providers earn rewards, typically in the form of the platform’s native crypto token.

This creates an interesting opportunity for crypto investors. By contributing their assets to the insurance fund, they not only support the overall health and stability of the DeFi ecosystem, but they also have the potential to earn a passive income. This is because the rewards they earn often have a higher yield than what they could achieve through traditional savings or investment methods.

What are the Key Benefits of DeFi Insurance?

There are many benefits to DeFi insurance including the following:

Claim Management: DeFi insurance streamlines the claim management process by leveraging smart contracts that can automatically evaluate and settle claims, reducing manual effort and providing faster compensation to policyholders.

Payment Flow: The use of blockchain technology ensures a smooth and transparent payment flow. It enables instant premium payments and policy payouts, improving the overall insurance experience for users.

Underwriting: DeFi insurance democratizes the underwriting process. It allows multiple participants to contribute to and manage risk pools, leading to individualized risk management and a more inclusive insurance ecosystem.

Transparency: DeFi insurance operates on blockchain technology which provides full transparency. All transactions are recorded on a public ledger that anyone can access, fostering trust among participants.

Accessibility: DeFi insurance platforms are typically open to anyone with internet access. This is in stark contrast to traditional insurance companies, which may impose various restrictions on who can buy a policy.

Efficiency: By automating various processes and removing the need for intermediaries, DeFi insurance can operate more efficiently than traditional insurance, potentially leading to lower costs for policyholders.

The Role of DeFi Insurance

In conclusion, DeFi insurance is a crucial component in the growth and acceptance of decentralized finance. It addresses the unique technical and economic risks in the DeFi ecosystem, providing necessary protection against smart contract failures and market inefficiencies.

As DeFi matures, insurance becomes not just beneficial, but essential for risk management. Platforms like Tidal Finance offer robust solutions tailored to the unique needs of the DeFi and traditional insurance sectors. As we move forward, DeFi insurance will undoubtedly play a key role in the evolution and widespread adoption of decentralized finance.